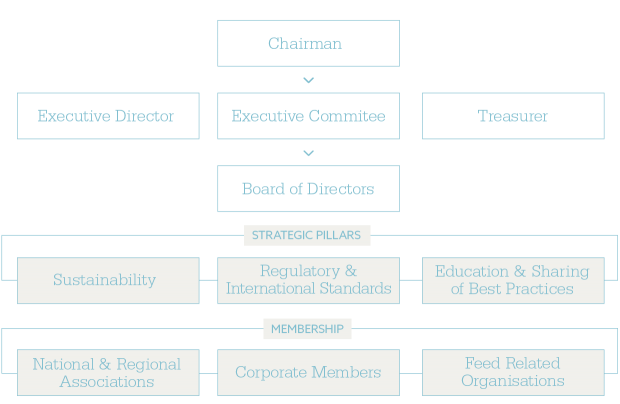

Through its membership and positioning within the larger Agricultural environment, AFMA is closely linked to related industries in the feed and food value chain where it plays a major role in strategically directing and aligning the feed industry in the larger agriculture sector.

The capacity in the AFMA Office over the past decade increased by more than 200% to keep-up with the ever expanding needs of its membership both locally as well as regionally.

The capacity in the AFMA Office over the past decade increased by more than 200% to keep-up with the ever expanding needs of its membership both locally as well as regionally. The AFMA Office also hosts the full secretariat of the South African Cereal and Oilseed Trade Association (SACOTA) and the Southern African Feed Manufacturers Association (SAFMA) established in 2013 at the 4th Global Feed & Food Congress (GFFC), held in Sun City, South Africa.

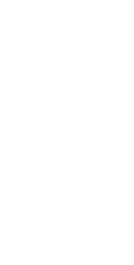

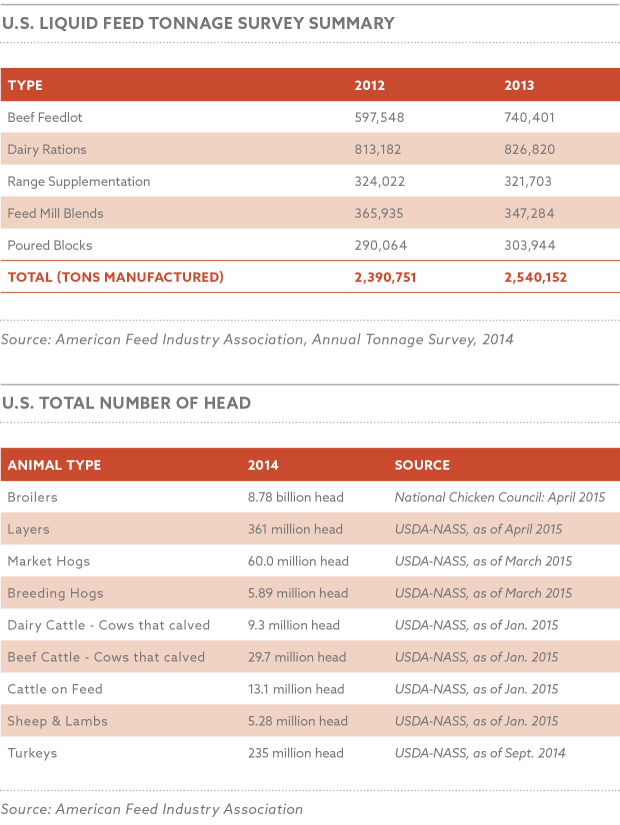

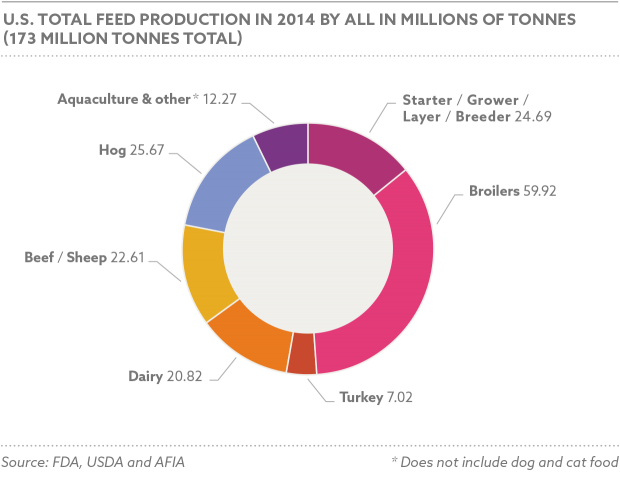

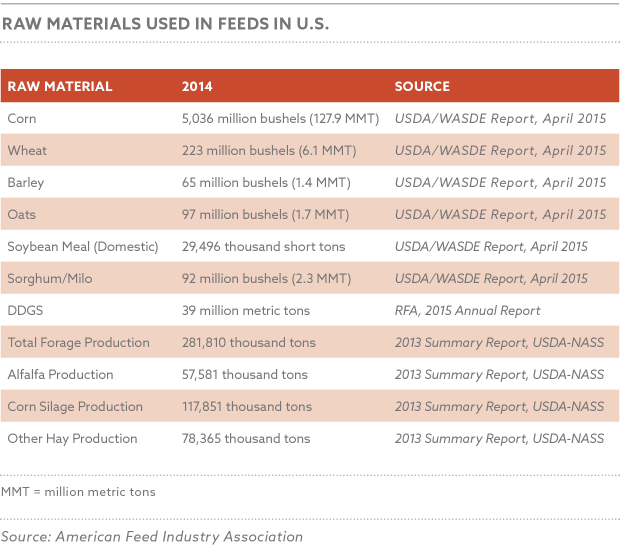

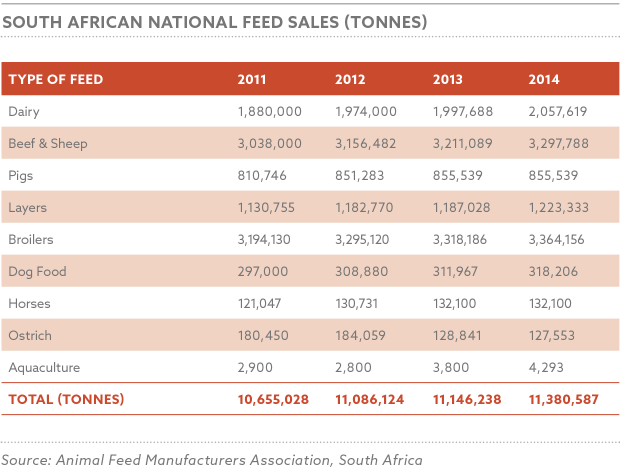

Feed Statistics

General Market Conditions

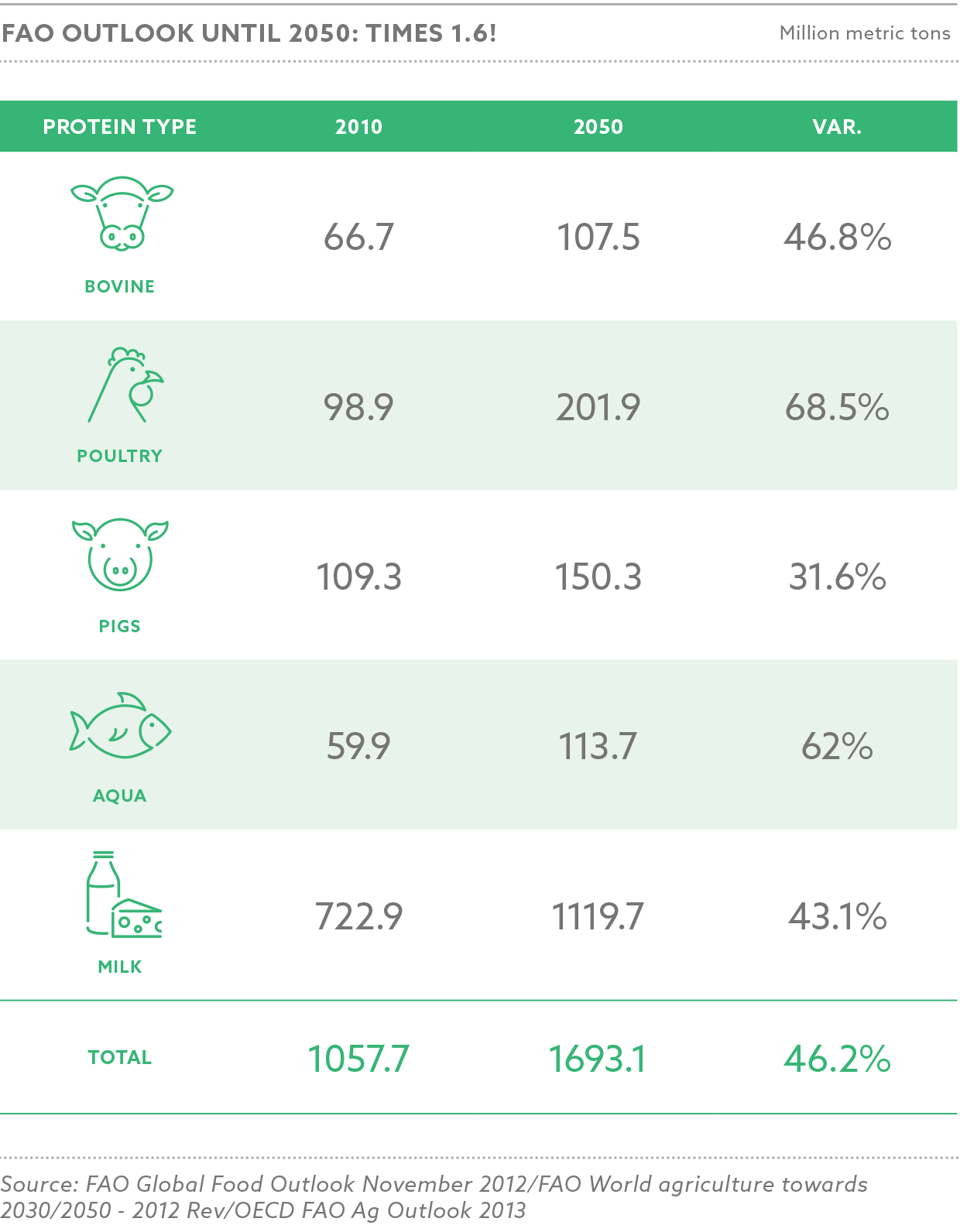

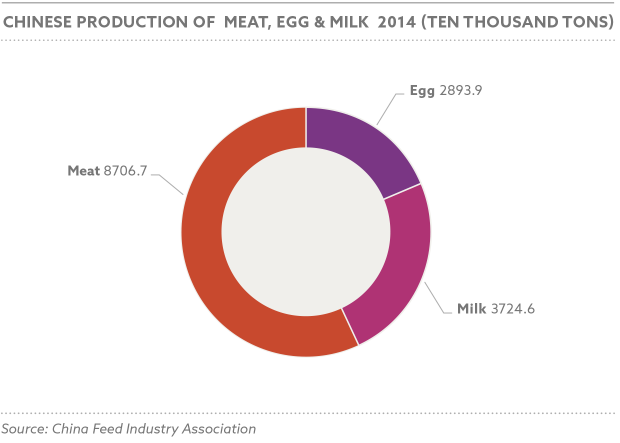

Growth in the South African agricultural production showed a substantial increase, reaching 5 % in 2013, compared to the 3.1 % in 2012. This was mainly attributed to growth in real income in the sector, as derived from growth in animal products, horticulture and field crops. Real income from animal products during 2013 was mainly made up by poultry meat (40.1 percent), cattle and calves slaughtered (19.7 percent), milk (13.8 percent) and eggs (10.8 percent), constituting 84 percent of this category. Prompted by the projected growth in production and firm domestic prices for chicken, beef and eggs, the real gross income from animal production was expected to increase by 7 percent in 2014.

Growth in the South African agricultural production showed a substantial increase, reaching 5 % in 2013, compared to the 3.1 % in 2012. This was mainly attributed to growth in real income in the sector, as derived from growth in animal products, horticulture and field crops.

While 2013 marked a return to profitability in the global context, local producers did not have the same benefit due to a substantial depreciation in the exchange rate, combined with severe drought conditions in South Africa and its neighbouring countries. While competitively priced imports prevented significant increases in local chicken prices in 2012, it placed extreme pressure on producer margins. However, a substantial depreciation in the exchange rate and higher international prices increased the cost of imported chicken in 2013. Domestic prices followed, yielding an increase of 7.7 % in the weighted average net sales realisation for frozen chicken in 2013. Chicken still remains the most affordable source of protein and although local consumption is projected to increase by only 34 % in the next decade, it continues to dominate the protein market.

Local Commodities Situation

After three seasons of constant increases in local commodity prices, it showed significant decreases due to positive global conditions and an estimated bumper summer grains and oilseed crop in 2013/14 season (ready for marketing in 2014/15). The combination of the estimated bumper summer grains and oilseed crop and the declining international maize price was expected to drive the local maize price much lower than in 2014. In fact, it was expected that the maize price would have to fall well below export parity levels to secure sufficient levels of exports that can clean out local surpluses resulting from the bumper crop, to enable a better price to producers.

The local maize price thus remained under pressure during 2014, largely as a result of weak international prices. In response to the lower expected maize price, both white and yellow maize plantings were expected to decrease marginally over the medium term until 2016. Local human consumption of white maize is projected to remain relatively constant over the long term, and any significant growth in white maize production will have to be absorbed by the export market or will have to substitute yellow maize in the feed market at a discounted price.

Feed demand has increased by 42 % over the past decade and it is expected to increase by a further 39 % during the next decade, which implies that more than 7 million tons of maize will be go to animals feeding, compared to human consumption of around 4.7 million tons.

According to the South African Bureau for Food and Agricultural Policy (BFAP), a strong growth is projected for maize from feed demand over the next decade, which will support the local yellow maize price over the long term. Feed demand has increased by 42 % over the past decade and it is expected to increase by a further 39 % during the next decade, which implies that more than 7 million tons of maize will be go to animals feeding, compared to human consumption of around 4.7 million tons.

The current local consumption of Soybean meal (SBM) is estimated at approximately 1.2 million tons, of which local production will provide 50 % of domestic demand, with the balance to be imported to fulfil local market demand.

Consumption is projected to increase to approximately 1.8 million tons in the next decade, with the largest part of local demand to be supplied by local production due to the expansion of local SBM crushing capacity.

The current local consumption of Soybean meal (SBM) is estimated at approximately 1.2 million tons, of which local production will provide 50 % of domestic demand, with the balance to be imported to fulfil local market demand.

Despite the increased local production, local SBM prices will remain a function of international prices and the exchange rate until sufficient SBM is produced in the local market to break away from import parity levels.

Domestic consumption of Sunflower meal is projected to increase from approximately 400 000 tons in 2014 to 550 000 tons in the next decade. As local production is expected to remain relatively constant, most of the increase in consumption will have to be provided by imports.

Domestic consumption of Sunflower meal is projected to increase from approximately 400 000 tons in 2014 to 550 000 tons in the next decade. As local production is expected to remain relatively constant, most of the increase in consumption will have to be provided by imports.

Associations Activities — Agricultural Regulatory and Policy Environment

Aniam Feeds Forum (AFF) (Act 36 - liaison meeting)

AFMA as leading livestock and feed association attends bimonthly liaison meetings with the Registrar of Farm Feeds, the Pet Food Industry (PFI) and Renderers Association of South Africa to discuss matters of importance to the feed industry. Through this forum, pertinent issues such as the new Feeds Bill, Regulations, Guidelines and Feed Registrations, Inspection Services, Rendering Facilities, and Trade issues are discussed in an open and transparent manner.

The year 2014 started off with the Registrar appointing an Assistant Technical Advisor to assist with the tremendous volume of feed registrations and to address the ever-increasing backlog of applications that require market approval. Despite this attempt, it was clear that the backlog will remain a critical concern for a sustainable feed industry and that it needs to be addressed as a matter of priority.

As part of the process to assist the Feed Regulator, AFMA facilitated a registration workshop in cooperation with the Feed Regulator on feed additives towards the end of 2013. The workshop was designed to provide the delegates with all the necessary information to successfully register a feed additive as either a farm feed or a stock remedy.

Simultaneously, it aimed at improving the quality of feed additive applications received by the Registrar, and thereby improving the workflow process within the division. The workshop was held over 2 days and was attended by more than 150 people from the animal feed and animal health industries. AFMA will continue to participate in these registration workshops in the coming year in an effort to keep its members equipped with the necessary information to submit accurate registration applications.

During 2014, a working group was formed within the AFF to specifically look at the manner in which the registration status is reported at the meeting and to ensure that relevant and accurate information is available to industry bodies. Historically, it has been a major obstacle for member companies to manage their business and marketing strategies without proper guidance on the expected lead times for registration approvals. The working group is therefore tasked to design a status report that will provide a true reflection of the number of submitted, completed and outstanding applications within the various categories of livestock feed, pet food and feed additives. AFMA is actively participating in this working group and will continue its involvement in the next period.

Following the successful example of the registration-working group, a scond working group has recently been formed to look at an Inspection Services Report, which is to be presented at the bimonthly Act 36 liaison meetings. This working group consists of representatives from the industry associations and the Head of Inspection Services in the Agriculture Inputs Control Division. The aim of the report is to provide feedback to industry on general trends of compliance and non-compliance.

The Feeds Bill

In March 2013, the Feeds Bill was tabled before the Parliamentary Portfolio Committee on Agriculture, Forestry and Fisheries, and all industry stakeholders and senior officials of the South African Department of Agriculture, Forestry and Fisheries (DAFF) were given an opportunity to present their comments and concerns in this regard. The Bill was referred back to DAFF to address the major issues raised in terms of the legal framework and to embark on a thorough consultation process that will involve all stakeholders and affected parties in South Africa.

During 2014, however, the consultation process has not progressed much, apart from confirmation that fertilizers will be excluded from the scope of the Bill. AFMA will assist the Feed Regulator in initiating a meeting between all the relevant stakeholders before the end of 2014 in order to convene a workshop where the principles of the Feeds Bill will be discussed and potentially agreed on.

Regulations and Guidelines of Act 36

The proposed regulation amendment of Act 36 was not implemented during 2014. AFMA submitted extensive comments on this legislation, and the Registrar’s office was tasked with amending the regulation accordingly. AFMA views this amendment as an interim measure until the Feeds Bill is approved, after which a revised set of regulations will be required. AFMA strongly recommended that the regulations to the Farm Feeds Act (Act 36) be diversified to accommodate the various types of manufacturing facilities and establishments, each with its unique requirements. This will enable the inspectors to customise their facility audits in line with Good Manufacturing Practices at each type of establishment, and to potentially minimise the disputes between industry and government about the interpretation and intention of the law. Progress on the proposed regulation is being discussed as a standing agenda item at the Act 36 liaison meetings, and feedback will be provided to members via the AFMA Technical Committee during the next reporting period.

The slow progress on the regulation amendment mentioned is an unfortunate consequence of the limited technical resources at the Registrar’s office. The Registrar encouraged industry to assist where possible and AFMA envisions that the technical expertise of the Technical Committee will increasingly be utilised in this regard in the coming years.

A draft guideline document on the registration process and requirements was circulated to the Act 36 liaison members at the beginning of the reporting period. This guideline is critical to communicate all requirements and procedures necessary for the successful registration of farm feeds. AFMA provided comprehensive comments on the draft document and it is expected that the final guideline will be published before the end of 2014.

Additional guidelines on specific data requirements such as stability testing, efficiency trials and related matters are planned for the next reporting period. AFMA encourages the effort to provide the public with relevant information that will improve the quality of registration applications. The AFMA Technical Committee will once again avail their technical resources to assist in this matter.

GMOs

Synchronisation of GMO events remains a huge challenge in the South African commodity trade and consequently feed and food environment. The Report of the National Agricultural Marketing Council (NAMC) – “Supply and Demand Estimates Committee Report”, indicated stock availability for processing of white maize for 15 days and yellow maize for 22 days at the end of April 2014. Certain GMO events not yet registered for commodity clearance in South Africa prevented imports of maize from traditional exporting countries such as Brazil, Argentina and the USA. Maize could, however, be imported from the Black Sea countries, but at higher prices and freight charges. In order to address the situation, AFMA, SACOTA, the South African National Seed Organisation (SANSOR) and Monsanto met with the GMO Registrar on 25 November 2013.

At the meeting, it was agreed that Monsanto would submit their outstanding application for commodity clearance and that the GMO Registrar would do its utmost to expedite the approval of the application. The Executive Council under the Genetically Modified Organisms Act (Act No. 15 of 1997) approved the Monsanto event at their meeting on 18 March 2014, which cleared the way for maize imports from one of South Africa’s traditional trading partners, Argentina.

In order to prevent a similar occurrence in future, AFMA and SACOTA met with SANSOR on 3 April 2014, where it was agreed that technology developers would be requested to synchronise GMO commodity import approvals in South Africa and major exporting countries. A proposal will also be drafted via the Maize Forum Steering Committee to the GMO Registrar to expedite the review of applications for GMO commodity imports, as well as to streamline the approval process for stacked events.

Self-Regulation

AFMA Code of Conduct

Since its inception and approval by the Annual General Meeting (AGM) in 2008, the AFMA Code of Conduct (AFMA Industry Certification Programme) has entered into its sixth year of implementation. Most of the AFMA members have already entered their third round of the Code of Conduct Compliance audit.

During 2014, the AFMA Technical Committee, as caretaker of the technical content of the Code and its auditing checklist, requested a review of the code and its auditing checklist to keep it up to date with the latest developments in the technical and legal environment, as well as the latest developments that impact on the feed and related industries.

The sub-committee responsible for the technical content has worked on the possible expansion of the Code, as well as on the audit checklist and its content. This sub-committee’s goal is to review and set the latest standard for the Code before engaging a second or third auditing and certifying service provider.

AFMA Transport Protocol

The AFMA Transport Protocol (laying down a set of rules on transporting of feed raw materials from the suppliers to the feed manufacturers) has been implemented. Its aim is to provide a mechanism for auditing transport providers against certain criteria in order to adhere to the principles of food safety.

Skills Transfer and Training Commitee Matters

Feed Miller curriculum development

The Feed Miller Curriculum had not yet been approved by the Quality Council for Trades and Occupations (QCTO), which means that the curriculum could not officially be registered with the South African Qualifications Authority (SAQA). AFMA’s Training Committee however, decided to proceed with the development process of learning material, despite the fact that the approval and registration process has not yet been finalised. AFMA has subsequently applied for funding from the Maize Trust, the Oilseeds and Protein Development Trust and the Agricultural Sector Education and Training Authority (AgriSETA) to fund the development of the learning material for the Curriculum.

AFMA has also embarked on a process to establish a training feed mill at the University of Pretoria (UP). This project has three objectives, i.e. the practical assessment of learners according to the Feed Miller qualification, feed processing research projects and academic programmes for undergraduate and postgraduate students. It is envisaged that the training feed mill will be financed by grants, sponsors and investments from different groups or a variety of role players currently involved in the South African feed industry. These could include suppliers of equipment and machinery for feed manufacturing, suppliers of IT products used in the feed mill environment, suppliers of software programmes used in the feed manufacturing environment and other input suppliers and service providers to the feed industry.

A joint initiative between AFMA, UP and the Kansas State University (KSU) will be the presentation of specialised short courses for the continuing professional development of the animal feed industry’s workforce. Short courses on feed milling technology will be aimed at current four-year animal science students.

Short courses will be presented by way of a weekly webinar by the faculty at KSU working with a faculty proctor at UP, while learning material will be made available through the distance education (DE) platform at KSU. Practical sessions will be conducted at the training feed mill, once established. Other universities and technical colleges will also be accommodated. Once the total project is up and running, it is envisaged that the initiatives will also be rolled out to feed manufacturers in other countries north of South Africa.

AFMA/Bühler/Swiss Institute of Feed Technology (SFT) Training

The AFMA/Bühler/SFT training course was presented from 6 to 17 October 2014. Other Southern African countries expressed an interest to also attend the training course.

AFMA Annual Symposium

The AFMA Annual Symposium hosting top local and international technical speakers is growing in stature every year it takes place, tabling excellent presentations on the most prominent and relevant topics which keep the South African industry informed on the latest development world-wide. Its prominence has over the years grown to such an extent, that other related industries and activities industries are using the AFMA Symposium as a corner stone event and are arranging other event before or after the Symposium.

For more information please visit: www.afma.co.za.

Print page

Print page