South Africa

AFMA

The Animal Feed Manufacturers Association of South Africa (AFMA) is the official industry representative trade organisation for the formal compound feed manufacturers of South Africa, producing the full range of animal feeds in the larger agricultural arena. This report covers activities during the reporting period 2021-22.

The Global Macro-economic Environment

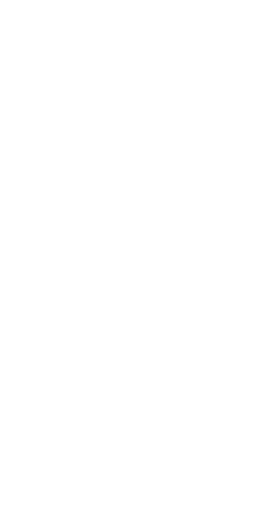

The year 2021 ended with a promise of a potential recovery of the global economy, with the International Monetary Fund (IMF) forecasting global growth of 4,9% in 2022, following a solid recovery of 6,1% in 2021.

However, this picture quickly changed when Russia invaded Ukraine, disrupting global value and supply chains and causing a sharp increase in oil, fertiliser, and agricultural commodity prices. This further raised concerns about inflationary risks in the developed world and the long-persistent impact of COVID-19 and monkeypox, which had continued to disrupt the value and supply chains, specifically in Asia, where there were still hard lockdowns in much of this year.

The IMF forecasted global growth at 3,2% (revised down from the previous estimate of 4,9%). The economy is likely to remain depressed through 2022/23, as the IMF places global growth at 2,9% for the year. Several shocks will continue to weigh on the global economy, such as; higher-than-expected inflation worldwide – especially in the United States and major European economies – triggering tighter financial conditions; a worse-than-anticipated slowdown in China, reflecting COVID-19 outbreaks and lockdowns; and further negative spillovers from the war in Ukraine.

Central banks worldwide were adamant about controlling inflation and ensuring inflation expectations remained anchored to their targets. Thus, their credibility had to be rebuilt following their misdiagnosis of the recent surge in inflation as temporary. Effectively, central banks accepted that if the economy finds itself in a recession due to their policy actions to bring inflation under control, so be it. Peak interest rates in the seven largest advanced economies were expected to be reached by September 2023, which implied that consumers and businesses could expect some tough times with higher interest rates over the next six to 18 months.

In fact, the developed economies slowed to 2,5% growth in 2022 (from a pre-war estimate of 4,4%) and 5,2% in 2021. In 2023, the developed economies were expected to underperform, estimated to grow at 1,4%. The United States, Euro Area, UK, and Canada were among the economies that were underperforming due to the shocks discussed. A slowdown in the developed world meant a decline in the demand for goods and exports from emerging markets. Such conditions will probably weigh down export-oriented economies such as South Africa.

The IMF forecasted growth in emerging and developing Asia at 4,6% in 2022 (from pre-war estimates of 5,2%) and 5,0 in 2023. This was a far better slowdown than observed in the developed world. The Asian economies and Saudi Arabia in the Middle East and Nigeria in the Sub-Saharan region were among the leading countries in this anticipated solid recovery. The higher oil prices have improved their income in the latter two countries, Saudi Arabia and Nigeria.

Inflation Rates

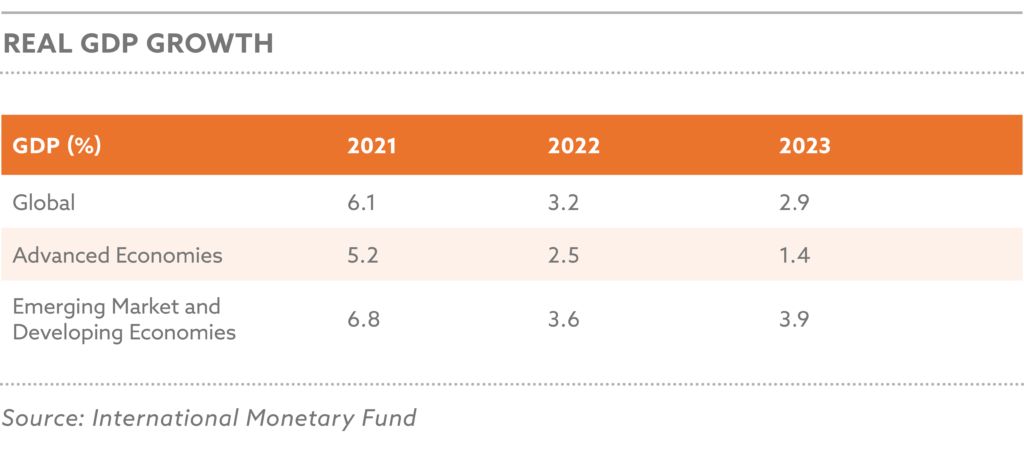

Inflation was and still is an important topic in the global financial world. There are several factors behind this surge in inflation.

Firstly, the disruptions in the supply chains during the COVID-19 intense period and the increased shipping costs were the core challenges leading to an uptick in global inflation.

Secondly, through unemployment wages and various forms, the economic stimulus in 2021 and partly in 2021 in the advanced economies such as the United States, Germany, United Kingdom, and other countries have increased consumer spending. This, in turn, has led to an uptick in consumer price inflation which in 2021 and into 2022.

Thirdly, the war in Ukraine further exacerbated the supply chain glitches and an increase in the oil and food process, thus pushing up inflation across the world. The World Bank forecasted consumer price inflation in the advanced economies at 6,6% y/y in 2021, a notable acceleration from 3,1% y/y in 2021.

In the emerging economies, there was an uptick in inflation, partly driven by increased food and energy prices, directly linked to the Russia and Ukraine war. The available data showed that consumer price inflation for the emerging markets accelerated to around 9,5% y/y in 2022, from 5,9% y/y in the previous year. The forecasts for 2023, however, show moderation to 7,3% y/y from 2022 (compared to 4,5% y/y in 2021) and accelerate further slowdown to 5,7% in 2023.

Unemployment

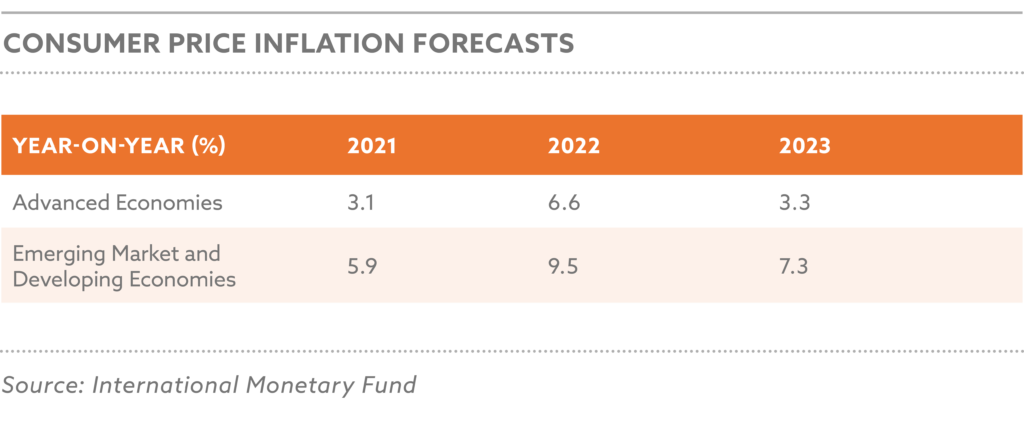

The business environment has changed since the start of the COVID-19 pandemic. The income support to households in the developed world incentivised people to stay out of work, especially work that was typically in undesirable conditions. But this income stimulus stopped at the end of 2021 in most countries. Still, the population had devised other means of self-employment when there was a boost in household incomes. This meant that countries like the United States struggled to find workers for various low-income jobs. In other countries, the increasing living costs, as reflected by the rising inflation, have persuaded people back to the labour market. Still, some struggled to find work, especially in strained economies and experiencing low growth. It is for these reasons that unemployment across the world remained at pretty high levels.

Local Macro-economic Conditions

On the domestic front, South Africa was one of the countries most hard hit by the COVID-19 pandemic and the disruptions in supply chains. However, during 2021, as the domestic economy opened, it promised a recovery, with the economy growing at 4,9%. As a small open economy, global economic developments tend to hit the South African economy the hardest. As such, South Africa experienced a continuous slowdown to 2,3% in 2022 and is expecting 1,4% in 2023.

These global shocks occurred in an environment where there were already several challenges, such as the slow-paced implementation of economic reforms outlined by the National Development Plan and, more recently, in the National Treasury paper in 2019. The electricity outages, inefficiency in the rail network, poorly maintained roads and water infrastructure, and non-performing municipalities were some of the issues that continue to constrain business activity and, thus, growth in the South African economy.

The growth mentioned above implied that the South African economy couldn’t create sufficient jobs for its working population over the foreseeable future. Hence, the country will be trapped in an environment of low growth, high unemployment, and inequality for some time. Such conditions could lead to social discomfort across communities, subsequently impacting business activity. An example of a manifestation of severe discomfort in the social society was experienced during the July 2021 social unrest in KwaZulu-Natal, which gave the nation a glimpse of the potential risk as a result of the underperformance of the South African economy and reluctance to implement reforms by the political leadership.

South African Inflation

This elevated inflation path led to a sharp increase in interest rates since the start of 2022. The South African Reserve Bank is expected to keep interest rates elevated over the next coming year as the Bank tries to control inflation through Monetary Policy instruments. The expected moderation in inflation to 5,7% in 2023 assumes an environment of elevated interest rates to bring inflation below its upper bound of 6,0% (the lower bound is 3%).

South African Unemployment

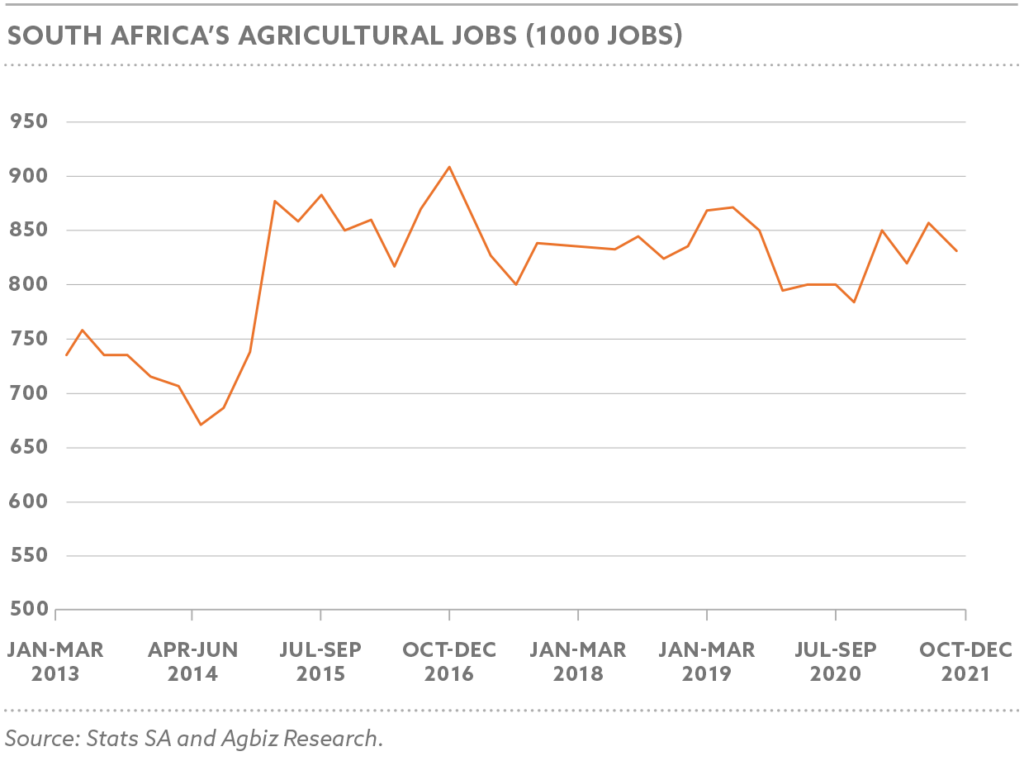

In the local South African market, the official data from Statistics South Africa showed a positive increase in jobs, a 7% year-on-year improvement in primary agriculture jobs to 844 389 jobs in the first quarter of 2022. This was well above the long-term agricultural employment of 780 000. The increased farm activity during the replanting process, combined with the decent deciduous fruit harvest, supported employment. Other subsectors, such as livestock, also contributed to employment. The subsectors that shaved employment during this period were forestry and aquaculture (ocean, coastal fishing, and fish farms).

The livestock and wool industries, confronted by rising feed costs and foot-and-mouth disease outbreaks leading to an export ban, are in uncertain territory and worth close monitoring.

Most subsectors in agriculture faced general challenges around the inadequate functioning of network industries and infrastructure – roads, rail, ports, water, and electricity, and poorly functioning municipalities, leading to increased business costs. Moreover, the challenging economic conditions in the country have, in some areas, led to labour unrest, which also requires a close eye. Still, one can be optimistic about agriculture’s ability to provide employment even in these challenging times.

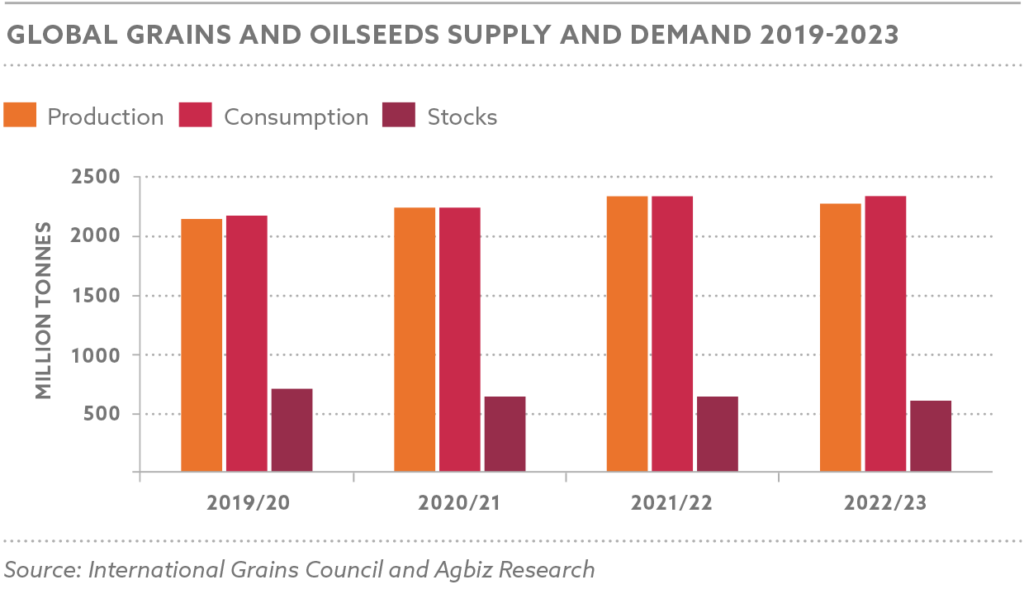

Global Grains and Oilseeds Outlook

The International Grains Council (IGC) forecasted 2021/22 global grains production at 2,3 billion tons, down by 2.9% from the previous season. This decline in harvest is mainly due to expected lower yield in Ukraine, the US, and Euro Area, amongst other regions. From a commodity perspective, maize and wheat are the key drivers of the potential decline in global grain production. And thus, the global grains stocks could fall during the period under review to an estimated 598 million tons, a 1% annual decline. This would result from both reductions in production and firm consumption levels. These dynamics added upward pressure on grain prices over the medium term. Still, the grain prices are expected to come off the levels seen after Russia invaded Ukraine when there was anxiety in the market.

Maize

The IGC forecasted the 2021/22 global maize production at a new peak of 1,2 billion tons, up 7.5% from the previous season. This is because of an expected deterioration in the harvest in the United States, Ukraine, Euro Area, and India. While production was anticipated to increase, the consumption of maize could remain firm at 1,2 million tons, with an estimated 722 million tons earmarked for feed use, while the rest for food and industrial use.

This means that the global maize stocks could stabilise, set at an increase of 1.4% year-on-year, estimated at 284 million tons. As such, global maize prices could remain elevated over the foreseeable future, although at much lower levels than months after Russia invaded Ukraine. The animal feed industry will likely remain under pressure at such times, as prices are unlikely to decline back to the 2019 levels.

Wheat

Moreover, the IGC forecasted the 2021/22 global wheat production at 780.9 million tons, up 1% from the previous season. Meanwhile, global wheat consumption is expected to remain firm, mildly up 1.4% from the 2020/21 season and estimated at 772 million tons.

The animal feed share in this global wheat consumption is forecast at 148 million tons. This volume is not all that different from the previous seasons. The rest is for food and industrial use. The decline in broad global harvest is underpinned by expectations of a poor crop in some regions of the Euro Area, Australia, Ukraine, Argentina, China and India. Due to increased production, the 2021/22 global wheat stocks are forecast at 274 million tons, down by 1.08 % from the previous season. This stock decline is another factor that could keep wheat prices somewhat elevated compared with the levels seen in 2019. However, the prices will likely fall from the levels seen months after Russia invaded Ukraine, a major wheat producer.

Soybean

Soybean is the only crop whose production forecasts are pretty robust. For example, the 2021/22 global soybean harvest is set to decline to 356.4 million tons, down 3.8 % year-on-year, while the 2022/23 estimates show an expansion of 3.5 % towards 369 million tons. The growth in plantings in the United States, combined with an expected increase in area plantings when the season starts in Brazil, Uruguay, and Argentina, are driving this expected large crop. However, one should keep the potential La Niña-induced dryness in South America and the heatwave in the United States in mind.

The 2021/22 soybeans global stocks will amount to 45.1 million tons, down by 18% from the previous season. To illustrate the robustness of the Soybean market. Estimates for 2022/23 indicate an expected 50.2 closing stock due to the expected expansion discussed. Such an improvement would pressure soybeans and their product prices across the vegetable oils market. The next few months will be vital for assessing whether this optimistic picture will hold or change.

Domestic Grain and the Oilseeds Outlook

Maize

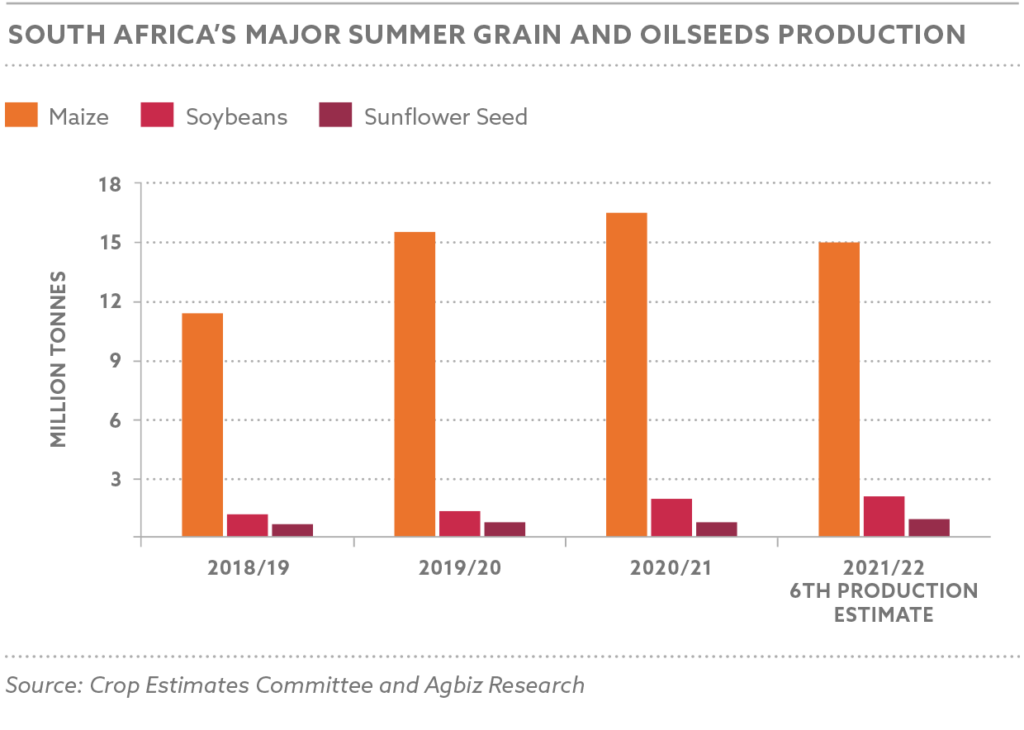

South Africa’s 2021/22 summer crops yielded yet again another excellent season. The Maize Crop delivered 15.38 million tons after an earlier estimate of 14,71 million tons in July. About 7,78 million tons are white maize, with 7,6 million tons being yellow maize.

Essentially, this is down by 6% from the 2020/21 season crop but well above the 10-year average maize harvest of 12,80 million tons and annual domestic consumption of 11,80 million tons. This means South Africa remains a net exporter of maize, which we anticipate to be just over 3,0 million tons in the 2022/23 marketing season (note: this marketing year corresponds with the 2021/22 production season).

Soya

Another important and most welcome crop development was the increase in South Africa’s soybean harvest for the 2021/22 season to a new highest crop of 2,2 million tons. This large soybean harvest will help reduce South Africa’s reliance on soybean meal imports. In the week of 22 July 2022, about 2,09 million tons had already been delivered to commercial silos.

Sunflower

Surprisingly, Sunflower seed delivered a 26% increase in production, amounting to 845 550 tons. The slow deliveries in sunflower seed regions partly explain this action. Still, the fact that the plantings started pretty late in these regions is also a factor to consider. For example, on 22 July 2022, about 792 050 tons had already been delivered to commercial silos.

Aside from these significant summer crops, the sorghum harvest is estimated at 136 200 (-3% m/m), dry beans harvest at 51 720 tons (-3% m/m), and groundnuts are at 49 000 tons (-11% m/m).

In sum, these domestic production data will have minimal impact on prices. Global events mainly influence domestic grain and oilseed prices. The Russia-Ukraine war worries and concerns about 2022/23 global production following reports of heatwaves and drought in the Northern Hemisphere continue to present upside support on prices, which are ultimately reflected in the South African grains market.

Still, the fact that domestic grains and oilseeds supplies are fairly higher provides comfort regarding domestic needs and even exports to our traditional markets. Ultimately, the relatively higher grains and oilseeds prices bode well for farmers in areas that didn’t experience much crop damage at the start of the season. Meanwhile, the consumers and the livestock will likely experience increased costs over the foreseeable future.

The Global Feed Situation

Since late 2019, the world has been in turmoil, facing a series of extraordinary situations impacting spheres no one could have imagined. COVID-19 has directly caused an unthinkable human catastrophe, with an estimated 600 million people globally contracting the virus, while 6.5 million deaths were reported at the time of this report.

While COVID-19 changed human lives dramatically, animal diseases dramatically affected the health of production animals and the global supply of animal protein. The most prominent animal diseases are African Swine Fever (ASF) and Highly Pathogenic Avian Influenza (HPAI), and closer to home, South Africa has been struggling to contain and manage Foot and Mouth Disease (FMD) for several years.

Thus, it is no surprise that these extraordinary situations spilt over to all aspects and segments of civilisation, disrupting everyday life as we knew it. More specifically, as feed manufacturers, the economic arena where we spend most of our time and effort was disrupted, bringing some segments to a grinding halt.

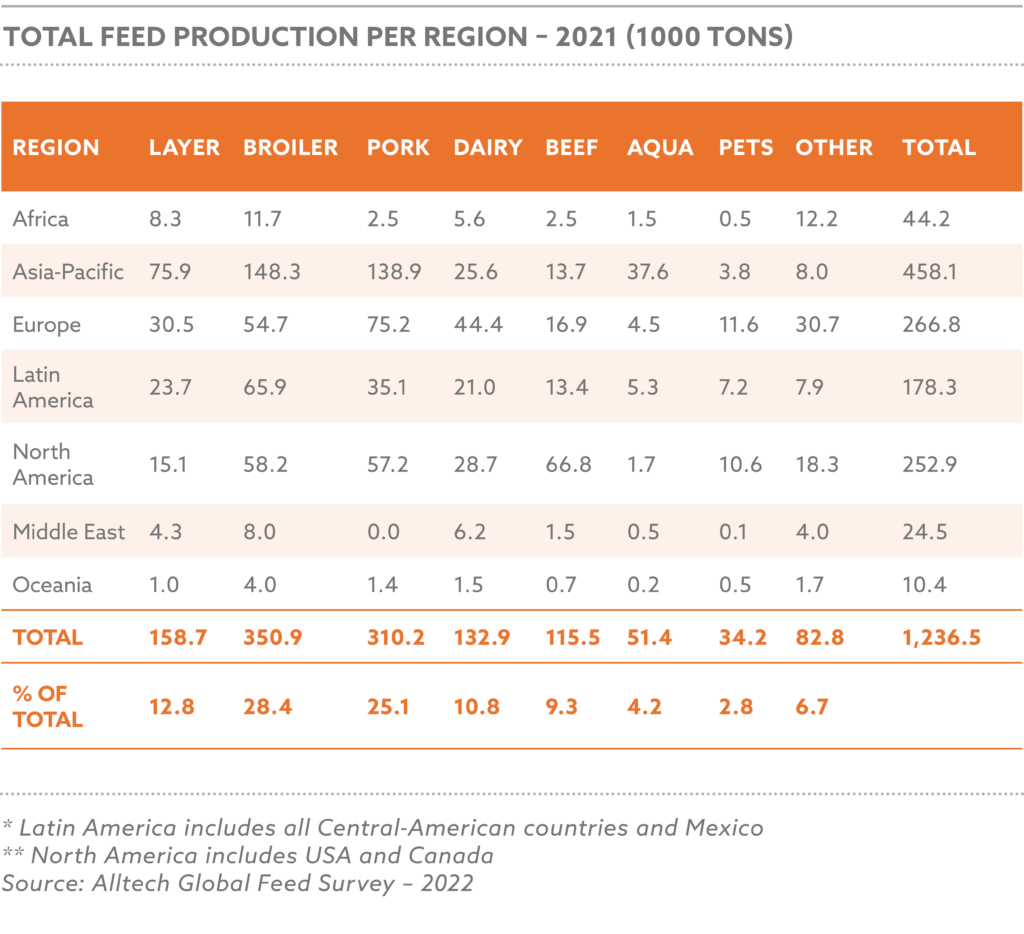

Feed and food, however, remain an essential global service to man and animal, and although being severely disrupted within the value chains and supply chains and having to make changes and having to adopt new processes and procedures for doing business in the COVID world, the international feed industry kept on supplying the world’s animal protein producers with feed, with global production totalling an estimated 1,235.5 million tons in 2021 versus 1,207.9 million tons in 2020.

Production exceeded expectations in many countries, mainly due to the recovery from COVID-19 lockdowns, with China remaining the world’s largest feed producer since 2020. The global pig sector rebounded from African Swine Fever (ASF) with a feed tonnage increase of more than 6%. In this recovery, China’s role was evident throughout the year while replenishing their pig herds lost to ASF.

Most agricultural stakeholders continue to focus on innovation and partnerships, which have proved essential to sustaining a business over the last year. If the future of agriculture is considered, there are various reasons to remain positive and optimistic.

The agricultural and agro-processing sectors have proven their resilience and energy in the face of challenges such as COVID-19, animal diseases, disruption of value, and supply chains. The global feeds sector has also shown its ability and appetite to continue growing and modernising to remain sustainable in the “New Normal” or whatever comes our way.

The top 10 feed-producing countries have increased to an estimated 65% of the global feed market share in 2021, showing an increase of 2%. If this list is expanded to the top 20 producing nations, they produce an estimated 80% of the global feed combined.

The global pig sector rebounded from African Swine Fever (ASF) with a feed tonnage increase of more than 6%, increasing from 286.4 million tons in 2020 to 310.2 tons in 2021. Broiler feed production also displayed a 4.9% growth from 334.6 million tons in 2020 to 350.9 tons in 2021.

AFMA’S Strategic Path Moving Forward

As reported in the previous IFIF Annual Report, AFMA has been crafting and re-shaping its Strategy since 2019, to be more outwards focused with the view – to unlock growth in the local agriculture value chain – through being more inclusive through fostering partnerships and close cooperation with fellow value chain partners.

Due to its unique positioning within these value chains and continuously shaping and building on AFMA’s vision, it is truly giving full meaning to – “The dynamic animal feed thought leader influencing food security through partnerships with all stakeholders”.

To remain relevant in any economic sector, organisations or companies need to ensure sustainability. Therefore, long-term partnerships within the various value chains should be fostered making and keeping it a reality.

Ultimately, the overarching goal in these partnerships is to ensure that sustainable growth is unlocked for all value chain partners – “any chain is only as strong as its weakest link”, highlighting the importance that the health and resilience of all links should be nurtured and developed to their optimum, ensuring an efficient and sustainable value chain.

AFMA’s new vision and mission have never been so strongly highlighted since 2020 when planning and groundwork were conducted to establish the National Framework of the Agricultural and Agricultural Processing Masterplan (AAMP). This followed an identical process because of the experience gained while shaping the SA Poultry Sector Masterplan (SAPMAP) in 2019, and even more so focused on the execution of the Mater Plans.

To strengthen AFMA’s strategic efforts and have the necessary knowledge and background of the different value chain inter-linkages, AFMA commissioned a Strategic Study on the South African Feed Industry: https://www.afma.co.za/download/the-south-african-feed-industry-a-strategic-perspective/?wpdmdl=10841 AFMA’s benefit of being centrally integrated as a value chain partner to several other value chains is indicated by the illustration.

<INSERT DIAGRAMS>

AFMA members are the largest suppliers to the SA poultry industry, supplying more than 4,5 million tons of the total 7.1 million tons produced, amounting to 63% of total AFMA feed sales. The balance of the production is beef & sheep, dairy, pork, and other species. The AFMA strategic focus will thus be on the core factors influencing the cost of raw materials and feed ingredients, which add up to 75% to 85% of the final feed cost. AFMA will remain a key partner in the grains and oilseeds value chains, exploring all possible options to increase the effectiveness and competitiveness of its members’ clients.

Besides being involved in the raw material supply side, AFMA is a critical supporting industry in the SAPMAP, supporting the SA poultry industry, its largest client. From a feed perspective, the main goal is parallel to the poultry development and expansion, ensuring sufficient feed and raw materials are always available.

AFMA closely cooperates with Grain SA and other grains and oilseeds value chain partners to execute the above. Critical in this role is to ensure enough maize and soy products are available due to AFMA being the largest single group of processors of maize and soy products in SA, primarily destined for poultry.

AFMA members are processing 3.5 million tons of maize and maize products and 1.2 million tons of soy and soy products into feed, of which 25% of all maize is available for the commercial market and 70-75% of all soy available for commercial processing in SA.

The AFMA strategic focus will thus be on the core factors influencing the cost of raw materials and feed ingredients, which add up to 75% to 85% of the final feed cost.

AFMA will remain a key partner in the grains and oilseeds value chains, exploring all possible options to increase the effectiveness and competitiveness of its members’ clients.

The South African Feed Situation

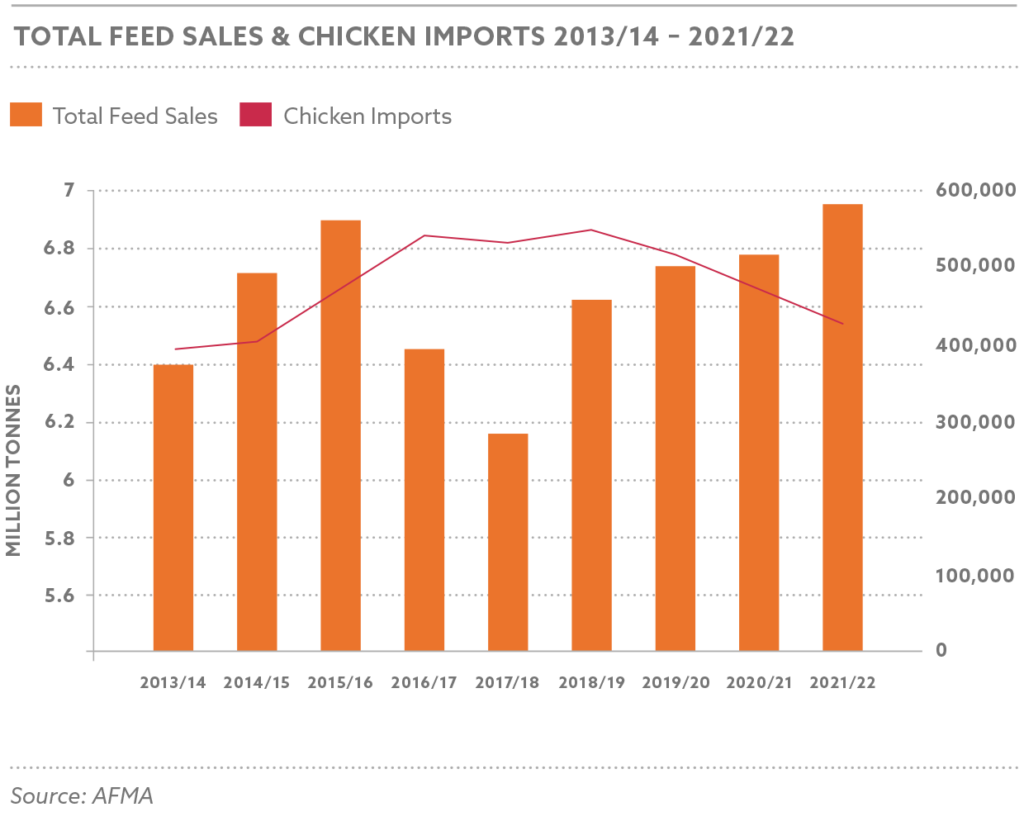

During 2016/17 and 2017/18, South Africa experienced some of the worst droughts in its history, impacting all segments of agricultural value chains and influencing both the human food and animal feed sectors. The continued severe drought forces producers to significantly reduce herd sizes due to the cost of feeding animals and keeping only breeding stock to rebuild herds once the drought conditions subside. During these years, AFMA feed sales suffered a triple blow (illegally dumped chicken, severe local drought conditions, and high commodity prices), leading to the most significant annual decrease in AFMA feed sales on record, dropping by 6.2%, which continued in 2017/18, by a further 1.9%.

Despite the extensive droughts and challenges, in 2016/17 and 2017/18, it provided insight into the high levels of illegally dumped chicken in the SA market from 2013/14. The reduction in chicken imports only started after the Poultry Industry started applying for unfair trade remedies (anti-dumping import duties). The industry was in distress, which gave way to the SA Poultry Sector Masterplan (SAPMAP).

As climatic and weather conditions improved, it gave way to more favourable commodity prices leading to the recovery of feed sales by 4.6% in 2018/19.

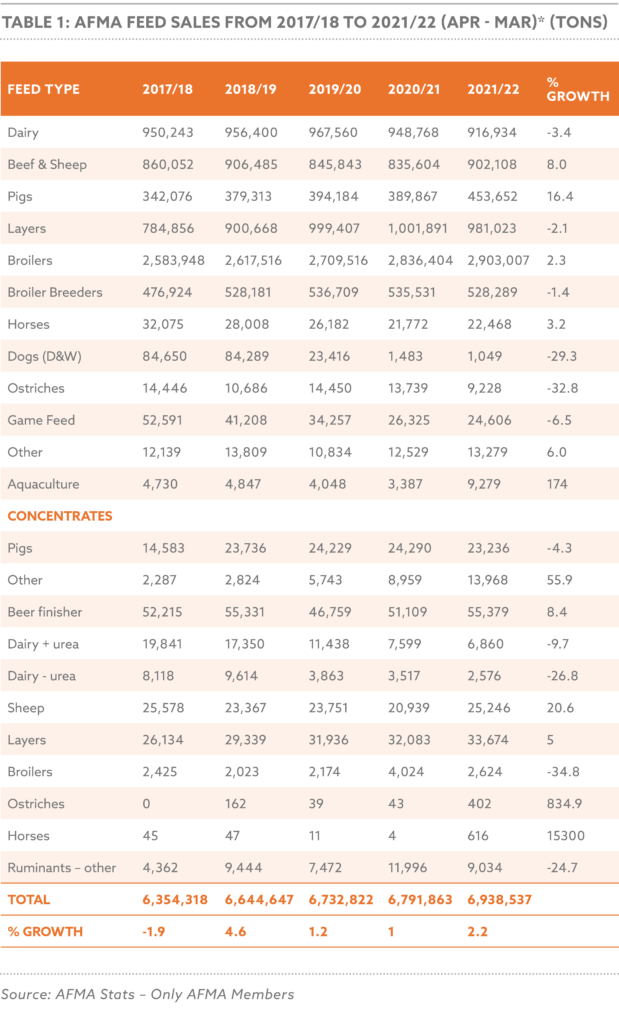

Due to various market influences, feed sales continued to recover consecutively, although at a slower pace and with different increments. Feed sales growth recovered by 1.2% in 2019/20, 1.0% in 2020/21 and a further 2.2%, amounting to 6 938 537 tons in 2021/22.

Despite four consecutive years of year-on-year volume growth, it is clear that AFMA feed sales do not reflect the theoretical potential which could have been achieved in a free and fair market with limited challenges. However, the feed industry’s off-takers face ongoing challenges on various fronts.

The poultry and livestock industries are facing one of the worst spells of a widespread conundrum of animal diseases. It is very rare that animal diseases challenge the poultry and livestock sectors at the same time. Poultry with Highly Pathogenic Avian Influenza (HPAI), Cloven hoofed animals with Foot & Mouth Disease (FMD), and the Pork Industry with African Swine Fever (ASF).

Suppose these local animal diseases aren’t enough. In that case, these industries have to deal with the combination of disjointed and disrupted global supply chains still trying to fully recover from the aftermath of the COVID-19 pandemic, which was dealt a further globally disruptive blow to which the extent isn’t calculated when Russia invaded Ukraine.

This gave way to increased uncertainty in the commodity markets, which were already jittery due to the effects of global climatic and weather conditions on Northern Hemisphere countries. This increased uncertainty was directly reflected in international commodity market pricing, leading to an increase in already high prices, sometimes moving up to global record prices. Examples of this were sunflower seed, sunflower oil and wheat, due to Ukraine and Russia being two of the major international producers and exporters of these commodities.

As one of the leading, supporting industries and a value chain partner of the Poultry and Livestock Industries, AFMA’s view is that growth in local feed production and sales would only be possible if the Poultry and Livestock Industries are successful in implementing the SAPMAP and AAMP, in direct partnership with Government, creating an export market for these economic sector’s produce.

National Feed Sales: 2021/22

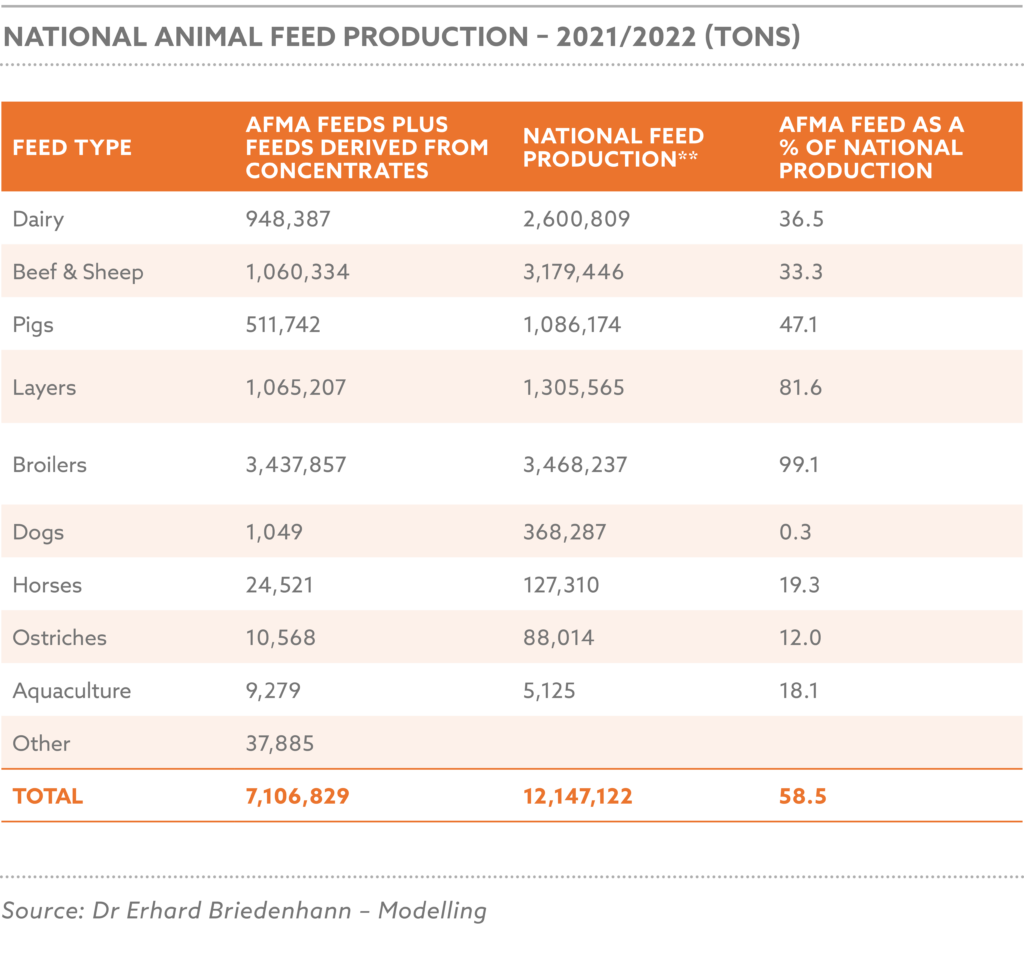

The above table shows AFMA’s market share versus national feed sales showed some changes between species. AFMA’s market share of dairy beef & sheep reduced while AFMA’s national market share increased in pig, layers, and broiler feeds. It should be noted that in a case where the AFMA’s sales volume exceeds the national volume, it must be regarded as feed exports to third countries.

National feed volumes for 2021/22 were calculated at 12 147 122 tons, recording a 1.6% increase in national feed sales.